FAB Balance Check 2026 – Complete Guide

Staying updated with your bank balance is extremely important—especially if you receive your salary through a FAB card or use FAB for daily payments. The FAB balance check facility makes this easier than ever. In 2026, First Abu Dhabi Bank (FAB) has improved its online and offline tools, helping customers instantly view balance, track transactions, and manage their finances with confidence.

In this detailed blog, we will explore what FAB Bank balance check is, the different methods to use it, its benefits, and how you can easily manage your money with FAB. Whether you are a new user or have been using FAB for years, this guide will walk you through everything in a simple and understandable way.

What Is an FAB Balance Check?

FAB balance check is a service offered by First Abu Dhabi Bank that allows customers to view their current account balance, recent transactions, salary deposits (for Ratibi or salary card users), and card-related information like card ID and status. This feature gives users an easy way to stay on top of their finances and track their spending habits efficiently.

FAB balance check

It offers real-time updates, meaning the amount you see is the exact balance at that moment. For customers who receive their salaries through FAB, this service is particularly useful to quickly confirm whether payments have been successfully deposited into their accounts.

Why FAB Balance Check Matters in 2026

In today’s fast-paced world, you can’t wait for a bank message or visit a branch every time you want to know your balance. this helps you:

- Monitor your finances on the go

- Confirm salary deposits instantly

- Avoid overdraft or extra deductions

- Track card usage securely

- Detect suspicious activity early

With FAB’s strong encryption and security, your banking information remains safe while being easily accessible anywhere, anytime.

Top Methods to Check FAB Balance (2026)

FAB offers multiple ways to check your balance. Below are the three most popular, fast, and reliable methods:

1. FAB Balance Check Through Website (Online Banking)

Fab Balance Check through website is the easiest method—no app download required.

Steps to Check FAB Balance on Website

- Visit the official FAB balance check portal.

- Enter the last two digits of your FAB card.

- Enter the 16-digit Card ID number printed on your card.

- Click Login.

- Your balance will instantly appear on the screen.

Why use this method?

This method requires no login credentials, works on any device, and is especially convenient for Ratibi and prepaid card holders who want a quick and hassle-free way to check their balance.

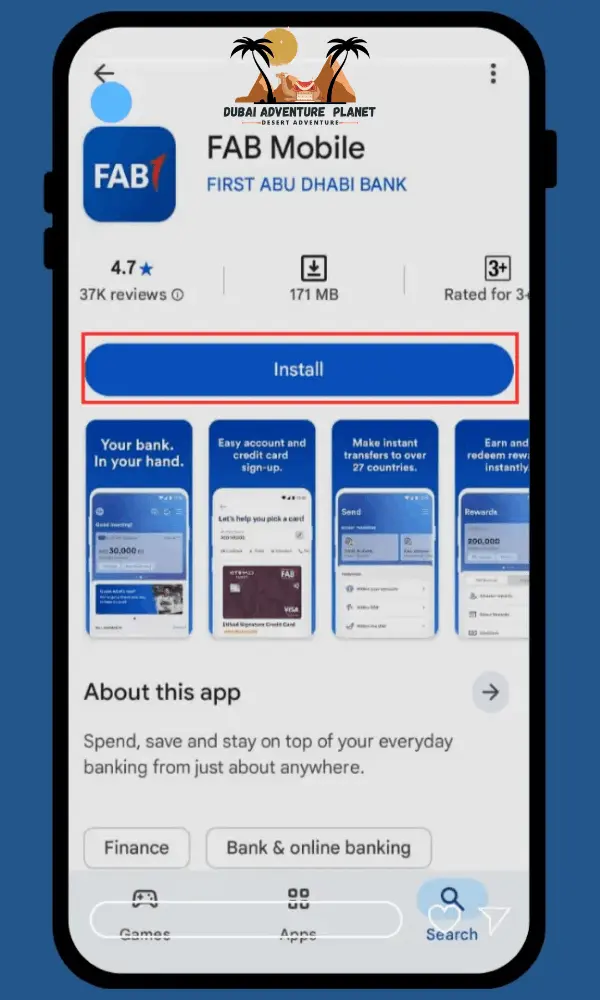

2. FAB Balance Check Using FAB Mobile App

If you check your balance regularly, the mobile app is the best option.

Steps to Check Balance Using FAB Mobile App

- Download the FAB Mobile App from Play Store or App Store.

- Open the app and enter:

- Customer ID or card number

- OTP (sent to your mobile/email)

- Create a PIN (first-time users only).

- Login to the app.

- Your balance will appear on the homepage.

Additional Features in FAB App

- View complete transaction history

- Transfer money locally/internationally

- Pay bills

- Manage debit/credit cards

- Contact support easily

3. FAB Balance Check via Mobile SMS

If you are registerd user for mobile banking, then it’s very simple.

- Open your phone’s SMS application with your registerd mobile no.

- Go for new message:

- Send to 2121

- Type Message: BAL XXXX – Type last four digits of your FAB account number

- There will be space between BAL and your digits (BAL 6789)

- Send message

with in seconds you will receive a message from fab about your balance.

4. FAB Balance Check Through ATM (Offline Method)

If you don’t have internet access, this method works best.

Steps to Check FAB Balance on ATM

- Visit any FAB ATM to Check Balance.

- Insert your card.

- Select Balance Inquiry.

- Enter your ATM PIN.

- Your balance will be displayed instantly.

This method is:

- Fast

- Simple

- Useful for non-smartphone users

FAB Salary Account Balance Check (Ratibi Card Users)

If you receive your salary through FAB (especially Ratibi prepaid card), the balance check process remains the same. Use:

- FAB website

- FAB app

- ATM

Ratibi card users do not need a bank account to check salary; only the card number and card ID are required.

How to Open a FAB Bank Account in 2026

FAB offers different account types:

- Salary Account

- Savings Account

- Current Account

Ways to Open a FAB Account

- Visit the nearest FAB branch

- Apply online through the FAB website

- Open an account using the FAB Mobile App

- Call FAB customer service

Documents Required

- Passport / Emirates ID

- Mobile number

- Address proof

- Salary slip (for salary account)

Once your account is created, you will receive a debit card that can be used for balance checks, ATM withdrawals, and online payments.

How to Activate FAB Mobile Banking

To enjoy full online banking features:

Steps to Activate Mobile Banking

- Download the FAB app.

- Click Register.

- Enter debit card details.

- Enter OTP sent to your mobile.

- Create a login password and 6-digit PIN.

Your mobile banking account will be activated instantly.

FAB Minimum Balance Requirement 2026

FAB has different balance rules based on account type:

Minimum Balance Rules

- Elite Savings Account → No minimum balance required

- Personal Savings Account → 3000 AED minimum balance required

If your balance drops below 3000 AED in a personal savings account, a 10 AED monthly penalty is charged.

FAB SWIFT Code 2026

FAB’s SWIFT Code is:

NBADAEAAXXX

This is required when sending or receiving international payments.

FAB Customer Care Contact (2026)

For any FAB-related help:

- Within UAE: 600 52 5500

- International: +971 2 6811511

Support is also available on FAB’s social media pages.

Advantages of Using FAB Balance Check

Here are some key benefits:

✔ Instant balance updates

✔ Multiple secure options (app, website, ATM)

✔ Salary confirmation in seconds

✔ 24/7 access

✔ Helps manage budgeting & expenses

✔ Detects fraud or wrong deductions early

Using the FAB balance check tool regularly ensures that your money stays secure and your financial planning stays on track.

FAQs – FAB Balance Check 2026

Q1. How can I check my FAB balance?

You can check your balance through the FAB website, FAB mobile app, or any FAB ATM.

Q2. What is the minimum balance in FAB?

Savings accounts require 3000 AED, while Elite savings accounts have no minimum balance rule.

Q3. How do I check my FAB salary card balance?

Use the FAB website balance check page and enter the card’s last 2 digits and 16-digit card ID.

Q4. Is there a fee for balance inquiry?

No, checking your FAB balance is completely free using online platforms and FAB ATMs.

Q5. What is the SWIFT code of FAB?

The SWIFT code is NBADAEAAXXX.

Q6: Can I check my FAB balance through SMS?

Yes, you can.

Q7: Is FAB banking available 24/7?

Yes, FAB online banking is available 24/7.

Q8: How can I reset my FAB online banking password?

Click “Forgot Password” on the FAB website or mobile app.

Q9: Can I check my FAB balance at an ATM?

Yes, you can.

Q10: Can I check my FAB balance through Mobile App?

Yes, you can.

Conclusion

FAB balance check is one of the most convenient and secure ways to manage your finances in 2026. Whether you’re using a salary card, prepaid card, or a full bank account, FAB provides multiple ways to instantly view your balance. With strong security features, real-time updates, and user-friendly tools, FAB ensures your financial life stays smooth and stress-free.

If you regularly want to monitor your salary or daily transactions, using the FAB app or website is the smartest choice.

All Categories

- Abra Dubai

- Abu Dhabi City Tour

- Adventure in Desert Safari

- Ai

- Ain Dubai

- Al Ain

- Al Fahidi Historical Neighborhood

- Al Faya Desert

- Al Qudra Desert

- Al Qudra Lake

- Atlantis Dubai

- Atlantis The Royal

- Attractions and Hidden Places

- Banking

- Beaches in Dubai

- Belly Dance In Desert Safari

- Bidayer Desert

- Burj Al Arab

- Burj Khalifa

- Business

- Camel Rides

- Camel Riding in Dubai

- Canary Club Dubai

- Deep Dive Dubai

- Deira Dubai

- Desert Safari

- Desert Safari Dubai

- Dhow Cruise Dubai

- Dolphin Show Dubai

- Downtown Dubai

- Dragon Mart

- Drift Beach Dubai

- Dubai

- Dubai Aquarium

- Dubai City Tour

- Dubai Creek Park

- Dubai Crocodile Park

- Dubai Fountain

- Dubai Frame

- Dubai Garden Glow

- Dubai International Airport

- Dubai Mall

- Dubai Marina Mall

- Dubai Marina Walk

- Dubai Parks And Resorts

- Dubai Safari Park

- Dubai Shopping Festival

- Dubai Skyline

- Dubai Water Canal

- Dune Buggy Dubai

- Eid ul Adha

- Eid-al-Fitr in Dubai

- Evening Desert Safari

- Expo 2020 Dubai

- Fun in Desert Safari

- Global Village Dubai

- Gold Souk Dubai

- Green Planet Dubai

- Hatta Dam

- Ibn Battuta Mall

- IMG World Dubai

- Jebel Jais

- Jet Ski Dubai

- Jumeirah Mosque

- Khor Fakkan

- Khorfakkan Waterfall

- Kite Beach Dubai

- La Mer Dubai

- Lahbab Desert

- Largest Mall in The World

- Love Lake Dubai

- Madame Tussauds Dubai

- Mall of the Emirates

- morning desert Safari Dubai

- Motiongate Dubai

- Museum Of The Future

- New Year's Eve

- Old Dubai

- OliOli Museum

- Overnight Desert Safari Dubai

- Palm Jumeirah

- Places to Visit in Ajman

- Places To Visit In Sharjah

- Quad Bike in Dubai

- Ras Al Khaimah

- Rashid Hospital Dubai

- Restaurants in Dubai

- Riverland Dubai

- Salt Bae Dubai

- Sharjah Aquarium

- Solo Travelers on a Desert Safari

- Sun During The Desert Safari Dubai

- Temperature in Dubai

- Theme Parks

- Things to do in Abu Dhabi

- Umm Suqeim Beach

- Uncategorized

- VR Park Dubai Mall

- World Trade Center Dubai

- Yacht Rental Dubai

- Zabeel Park Dubai